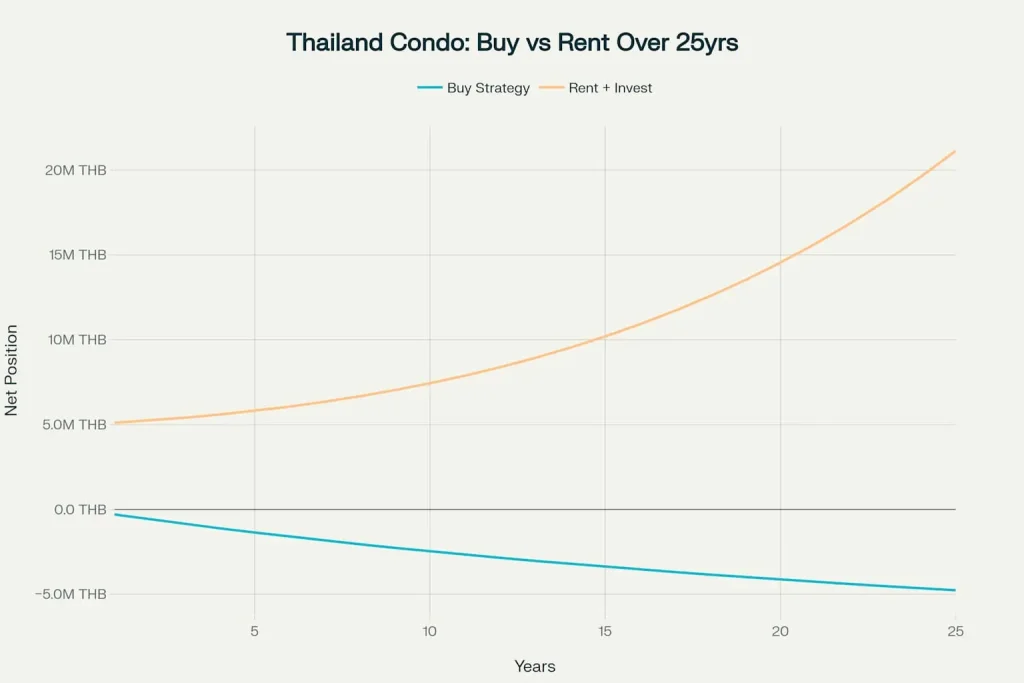

Thinking of buying a condo in Thailand? The shocking numbers reveal why renting could save you millions. Discover the brutal truth most real estate agents won't tell you about Thailand property investment.

You're about to make the most expensive mistake of your expat life in Thailand.

Picture this: You've fallen in love with that sleek Bangkok high-rise or dreamy Pattaya beachfront condo. The sales agent is promising guaranteed returns, lifestyle freedom, and the ultimate expat status symbol. But here's what they won't tell you – the cold, hard mathematics that could save you from financial disaster.

The shocking reality? That 5 million baht condo could have been rented for over 20 years for the same price. And if you'd invested that money instead, you'd be earning enough to cover your rent AND build wealth. Still think buying is the smart move? Let's dive into the numbers that will change everything.

The Million-Baht Math That Changes Everything

Breaking Down the Real Numbers

When you examine buying vs renting condo Thailand scenarios, the mathematics are brutally clear. According to recent market data from the Real Estate Information Center, the average foreign-purchased condo in Thailand costs 4.7 million baht, while equivalent rental properties average 15,000-20,000 baht monthly.

The 5 Million Baht Condo Trap:

- Purchase price: 5,000,000 THB

- Equivalent monthly rent: 20,000 THB

- Break-even timeline: 250 months (over 20 years!)

- This calculation excludes maintenance fees, repairs, and property depreciation at Thailand's standard 5% annual building depreciation rate.

The Investment Alternative:

- 5M THB invested in diversified portfolios averaging 7% annual returns

- Annual income: 350,000 THB (29,166 THB monthly)

- Result: Your investment income covers rent with surplus remaining

- Bonus: Your original 5 million stays intact and grows

Why Thailand Condo Investment Mistakes Are So Common

Foreign buyers consistently fall into predictable traps when making Thailand condo investment mistakes. The primary issue stems from emotional decision-making rather than financial analysis. Real estate agents exploit the dream of tropical ownership, but rarely discuss the harsh realities of Thailand's property market dynamics.

Recent data shows that foreign property buyers Thailand face unique challenges that domestic investors don't encounter. The 49% foreign ownership quota in condominium buildings means foreigners often pay premium prices for limited inventory, while Thai nationals access the same buildings at significantly lower costs.

Market Intelligence Data

Thailand Property Market Statistics (2024-2025):

| Metric | Value | Impact |

|---|---|---|

| Average Foreign Condo Price | 4.7M THB | 15% above 2023 levels |

| Monthly Rent (Bangkok Premium) | 15,000-25,000 THB | Stable demand |

| Building Depreciation Rate | 5% annually | Legal requirement |

| Actual Net Rental Yield | 3-4% | Below developer claims |

| Housing Loan Rejection Rate | 70% | Tightened lending |

| Chinese Buyer Decline | -14.3% | Market shift |

These statistics provide concrete evidence supporting the rent-over-buy thesis.

The Hidden Nightmares of Condo Ownership in Thailand

Construction Quality Crisis

Thailand real estate pitfalls extend far beyond purchase price considerations. Investigation of completed projects reveals systematic construction quality issues that devastate long-term property values. Buildings constructed with cost-cutting materials show deterioration within 5-10 years, creating expensive maintenance obligations for owners.

The condo depreciation Thailand rate of 5% annually, as established by Thai tax law, reflects realistic expectations about building lifespan and quality. This depreciation isn't just accounting – it represents actual value loss that owners experience when attempting resales.

The Resale Reality Check

Thailand condo resale problems represent perhaps the most devastating aspect of foreign ownership. Thai buyers demonstrate strong preference for new constructions, viewing pre-owned condos as less desirable regardless of condition or location. This cultural preference creates a secondary market where foreign-owned units sell at 20-40% discounts compared to original purchase prices.

Market analysis reveals that Bangkok condo rental market dynamics favor property renters over owners in most scenarios. High-occupancy rental buildings generate steady income for investors who own multiple units, but individual foreign owners struggle to achieve profitable rental yields due to management complexities and regulatory restrictions.

Legal and Regulatory Complications

Thailand property ownership laws create additional layers of complexity that many foreign buyers underestimate. The recent tightening of regulations around nominee company structures means that alternative ownership methods carry increased legal risks. Changes to visa policies, property transfer taxes, and foreign exchange regulations can dramatically impact ownership costs and exit strategies.

When Market Dynamics Work Against Foreign Owners

The Oversupply Problem

Current market data indicates significant oversupply in many Bangkok and resort area condo markets. New project launches consistently exceed absorption rates, creating competitive pressure that suppresses resale values. This oversupply particularly impacts foreign-owned units, as developers continue targeting the limited 49% foreign quota with premium-priced inventory.

Economic Factors Impacting Returns

Bangkok property investment returns have underperformed broader investment markets over the past decade. While promotional materials often cite rental yields of 6-8%, realistic analysis of actual rental income, vacancy periods, management costs, and maintenance expenses typically produces net yields below 3-4% annually.

Thailand's economic fundamentals, including high household debt levels and banking sector tightening, have reduced domestic purchasing power. This economic environment limits the pool of potential buyers for resale properties, further suppressing secondary market values.

The Foreign Buyer Decline

Recent statistics show expat property regrets Thailand are becoming more common as market conditions deteriorate. Chinese purchases declined 14.3% in 2024, while Russian buyers face ongoing sanctions-related complications. This reduction in foreign demand creates additional downward pressure on resale markets that primarily serve international buyers.

The Smart Alternative: Rent and Invest Strategy

Financial Freedom Through Flexibility

Successful expats increasingly adopt rent-and-invest strategies that provide superior financial outcomes compared to property ownership. By renting quality accommodation for 15,000-25,000 THB monthly and investing purchase capital in diversified portfolios, expats maintain liquidity while building wealth.

This approach provides multiple advantages:

- Mobility: Easy relocation for job opportunities or lifestyle changes

- Capital preservation: Investment funds remain liquid and accessible

- Risk reduction: No exposure to Thai property market volatility

- Income generation: Investment returns often exceed rental costs

Avoiding the Ownership Trap

The psychological appeal of property ownership in paradise often overrides rational financial analysis. However, successful long-term expats recognize that Thailand condo investment mistakes typically stem from emotional rather than economic decision-making.

Rental arrangements provide access to premium properties and locations without the capital commitment and ongoing obligations of ownership. This flexibility proves particularly valuable in Thailand's dynamic economic and regulatory environment.

Market Realities for 2025 and Beyond

Projected Market Performance

Industry forecasts suggest modest 2-7% property price growth for 2025, significantly below historical investment market returns. This projected growth fails to compensate for ownership costs, transaction fees, and opportunity costs of capital deployment.

The Bangkok condo rental market shows stronger fundamentals than sales markets, with steady demand from working professionals and expatriates. This rental demand provides sustainable income opportunities for professional property investors but offers limited benefits for individual foreign owners seeking capital appreciation.

Regulatory Changes on the Horizon

Ongoing discussions about foreign ownership restrictions and property taxation suggest potential future complications for international property owners. Recent BOI rule changes and increased scrutiny of nominee company structures indicate a regulatory environment that may become more restrictive rather than more accommodating for foreign investors.

Making the Right Decision for Your Situation

When Buying Might Make Sense

Property purchase in Thailand makes financial sense only in very specific circumstances:

- Long-term residence commitment: Planning to live in the same location for 20+ years

- Exceptional property identification: Rare, high-demand locations with proven appreciation history

- Surplus capital deployment: Investment represents small percentage of total wealth

The Rent-and-Invest Advantage

For most expats, renting premium accommodation while investing purchase capital provides superior financial outcomes:

- Diversified portfolio growth: Access to global investment opportunities

- Maintained liquidity: Capital available for emergencies or opportunities

- Reduced stress: No property management or maintenance obligations

- Geographic flexibility: Easy relocation as circumstances change

Conclusion: Don't Be a Statistic

The data overwhelmingly supports rental strategies over property purchase for most foreign residents in Thailand. While property ownership provides psychological satisfaction, the financial mathematics clearly favor alternative approaches that preserve capital while providing housing solutions.

Thailand condo investment mistakes are entirely avoidable through proper financial analysis and realistic market assessment. The dream of tropical property ownership often becomes a financial nightmare when market realities collide with promotional promises.

Smart expats recognize that true wealth building comes from making rational financial decisions rather than emotional property purchases. By choosing rental accommodation and intelligent capital deployment, you can enjoy Thailand's lifestyle benefits while building long-term financial security.

The choice is yours: Join the growing number of expat property regrets Thailand statistics, or make the financially intelligent decision that preserves and grows your wealth while providing the lifestyle you desire.

Your financial future depends on making this decision based on mathematics, not emotions.

You’ve articulated this so well—spot on!

You just saved me from making a very expensive mistake!